A description with the house in ample element underneath the instances (taking into account the value of your residence) for someone not normally informed about the sort of home to understand that The outline is with the contributed house;

If your recipient (or A different man or woman) assumes the debt, you should also lessen the FMV from the home by the level of the outstanding personal debt assumed.

Because these travel expenses usually are not business-connected, they are not issue to a similar limitations as business enterprise-related expenditures. For information on business travel costs, see

You don't lead the rest of your passions during the property to the first receiver or, if it no longer exists, One more qualified Firm on or in advance of the sooner of:

The car donation procedures just described Really don't utilize to donations of stock. for instance, these rules Do not use In case you donating money for tax purposes are an automobile vendor who donates an automobile you had been holding available for purchase to consumers. See

on account of their complexity plus the confined amount of taxpayers to whom these extra guidelines implement, they aren't mentioned On this publication. If you need to figure a carryover and you are in one of those situations, you might want to consult which has a tax practitioner.

you will need to have the acknowledgment on or prior to the earlier of: The day you file your return for your year you make the contribution, or

it's essential to make the selection with your primary return or on an amended return submitted through the because of day for filing the original return.

If you grant a charity an choice to obtain real property in a bargain cost, it's not a contribution until finally the charity exercise routines the choice.

Enter your contributions of cash gain house to certified businesses that aren't 50% limit companies. Never involve any contributions you entered on a previous line

quantities you expend doing providers for your charitable Corporation might be deductible as a contribution to a professional Corporation.

in the event you make a payment or transfer assets to or for using an experienced organization and receive or assume to receive a point out or community tax credit history in return, then the quantity taken care of to be a charitable contribution deduction is lessened by the level of the condition or area tax credit rating you receive or hope to receive in consideration for the payment or transfer, but an exception might utilize.

you should recapture section of your charitable contribution deduction by which include it in your income if all the next statements are true.

comprehending Tax Deductions: Itemized vs. typical Deduction A tax deduction lessens your taxable income And just how much tax you owe. you'll be able to itemize your deductions or take a fixed volume Along with the normal deduction.

Rick Moranis Then & Now!

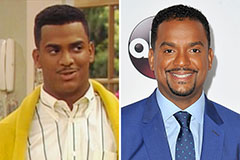

Rick Moranis Then & Now! Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Melissa Joan Hart Then & Now!

Melissa Joan Hart Then & Now! Sydney Simpson Then & Now!

Sydney Simpson Then & Now!